Insights

Digital Finance Readiness in Investment Institutions: A Benchmarking Study

In November 2022, we commissioned Oxford Economics to conduct a survey of 300 investment institutions, divided almost evenly among asset managers, asset owners and insurers, on their approaches to digital assets and investment technology.

February 2023

James Redgrave

Head of Thought Leadership and Editorial, State Street DigitalSM

It follows the 2021 Digital Assets Survey, but significantly expands on that research by looking into organizations’ preparedness for incorporating code-based smart contracts, blockchains and other distributed ledger technologies into their investment processes for tokenized versions of traditional securities. The study examines respondents’ expectations of the likelihood of these developments, the timescales required for their mainstream adoption by investment institutions, the ecosystem of firms in which they operate, the potential benefits for their clients and different areas of their operations, and the challenges posed by transitioning to such a model.

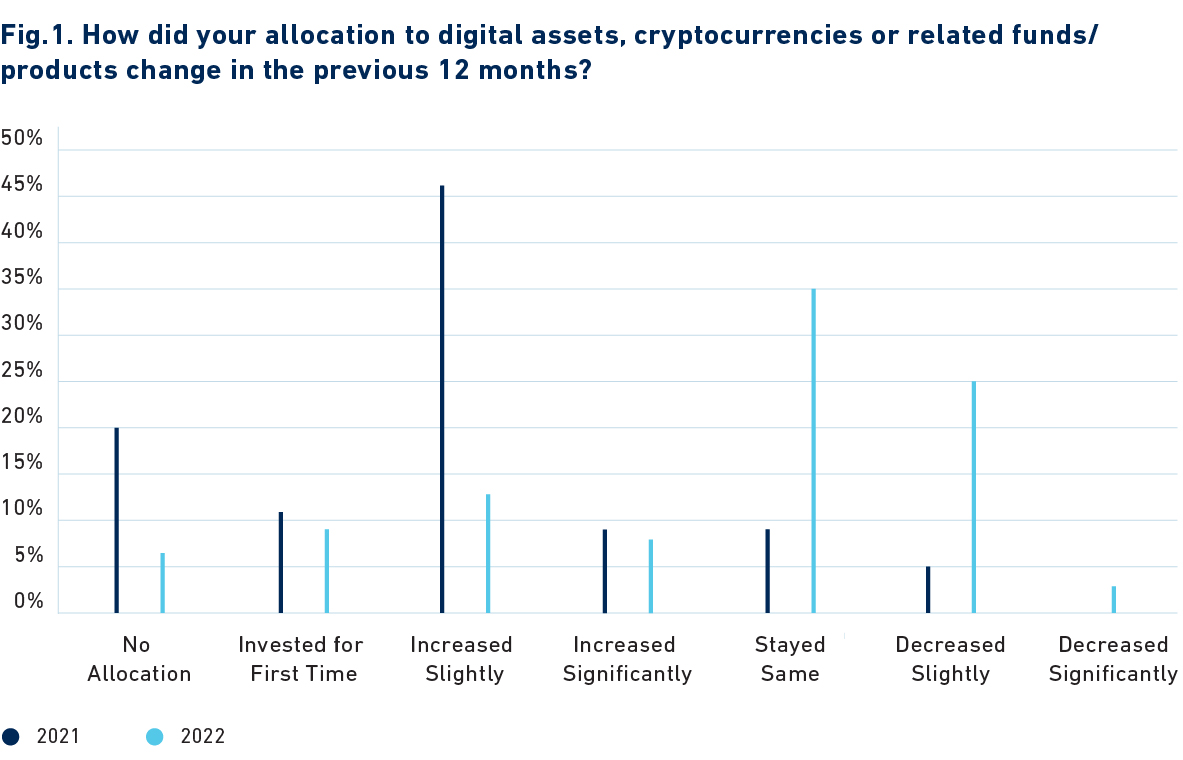

Market pulse: Institutional digital asset allocations are slowing

Institutional investors were more likely to decrease their allocations to digital assets this year (28 percent, compared to 21 percent who increased), while leaving allocations unchanged (35 percent) accounted for the largest single response.1 In the 2021 survey, more than half of respondents (55 percent) had increased their digital asset portfolios, compared to just 14 percent who had either decreased or not changed theirs.

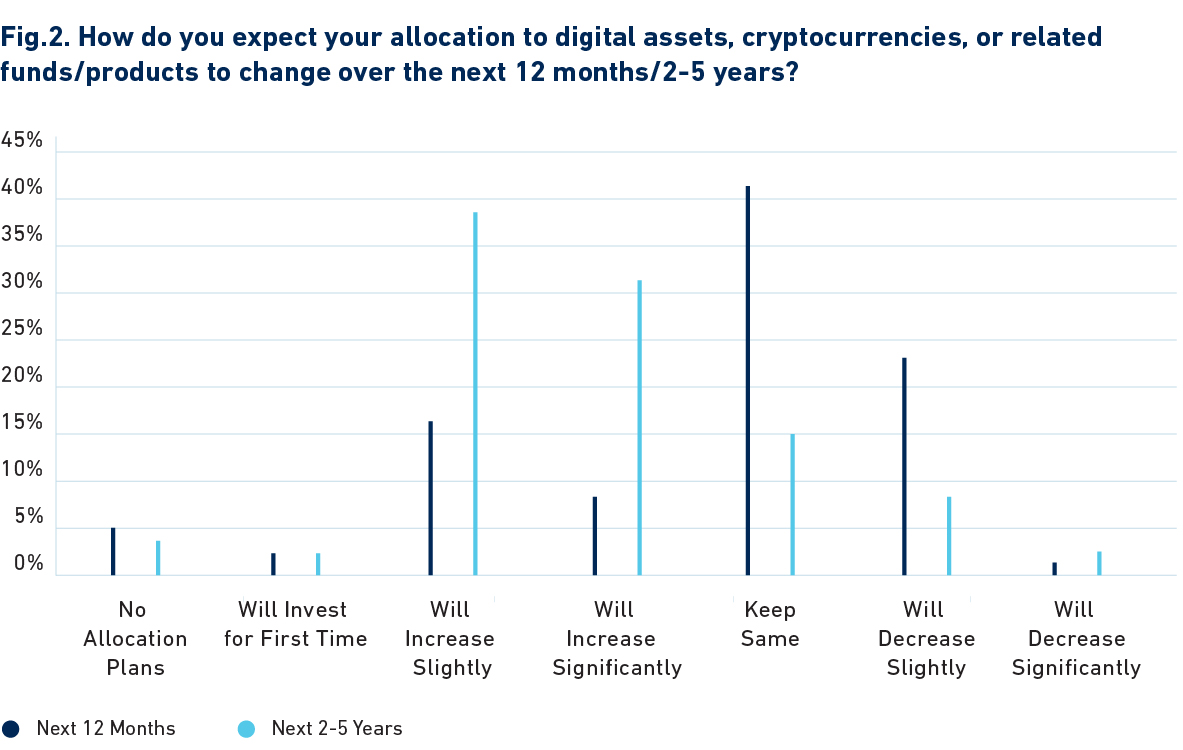

The number of investors increasing their digital assets exposure in 2022 was also significantly lower than those who had planned to do so in 2021 (70 percent said they would be growing their allocations the following year). In this survey, respondents were considerably more bearish on their future investment plans. A quarter of respondents said they would increase their digital asset allocations in 2023, while the same number said they would decrease theirs, and 42 percent said that they were not planning to change their allocations. However, longer-term investment plans were more positive for digital assets, with 69 percent planning to increase holdings over the next two-to-five years, and only 26 percent anticipating either a decrease or no change over this period.

Allocations varied by investor type. For example, asset owners and insurers were much more likely to have sold digital assets this year (35 percent for both segments) than asset managers (14 percent). Similarly, 32 percent of insurers and 28 percent of asset owners plan to decrease their portfolios this year, compared to just 16 percent of asset managers. Asset managers, for their part, were more strongly inclined to hold their digital asset allocations at a steady level, with 44 percent not changing over the course of 2022, and 49 percent not planning to in 2023.

Beyond crypto: Investment institutions are starting to explore the wider applications of digital investment technology

Decentralized asset tokens, including tokenized versions of traditional asset classes, were the digital asset types that the plurality of respondents (39 percent) felt would add the most value to their portfolios by investing directly. Cryptocurrencies were second (24 percent) followed by non-fungible tokens (16 percent), while nine percent preferred investment into firms providing the technology behind digital assets.

Institutions varied widely – in their understanding of, and readiness for – the digital tokenization and trading of traditional financial assets. A potentially surprising 11 percent of respondents claimed to be pioneers in “using code-based smart contracts to trade tokenized versions of traditional assets on a distributed ledger/blockchain,” and nearly a quarter more (22 percent) said they were ready to do so; however, had not yet. Meanwhile, 40 percent said they were not able to do this and were putting strategies and relationships in place to do so, and 27 percent had not yet reached the planning stage.

Firms were also divided on their approaches to a digital asset strategy, with most of them following some combination of training existing staff, hiring expertise and partnering with (or investing in) expert third parties.

This split is further replicated in the respondents’ expectations of the timescale in which this kind of technology would develop. While only five percent of respondents said “digital trading becoming a commonplace form of transferring mainstream assets in the fund industry” would never happen, the same number thought it was imminent (within the next one-to-two years). A little over a third (37 percent) felt it would take more than a decade; 23 percent said five-to-nine years; 13 percent said three-to-four years, and 17 percent did not make a guess.

Again, different institution types showed different attitudes here. Although roughly equal numbers of asset managers, owners and insurers claimed to be pioneers in traditional asset tokenization, managers were more likely to describe themselves as “well-prepared” (30 percent) compared to 21 percent of insurers and 16 percent of asset owners. They were also less likely to dismiss the technology entirely (one percent, compared to seven percent and six percent, respectively, for insurers and owners) and had generally higher expectations of this technology becoming mainstream quickly (26 percent expect this in under five years, compared to 15 percent of owners and 12 percent of insurers).

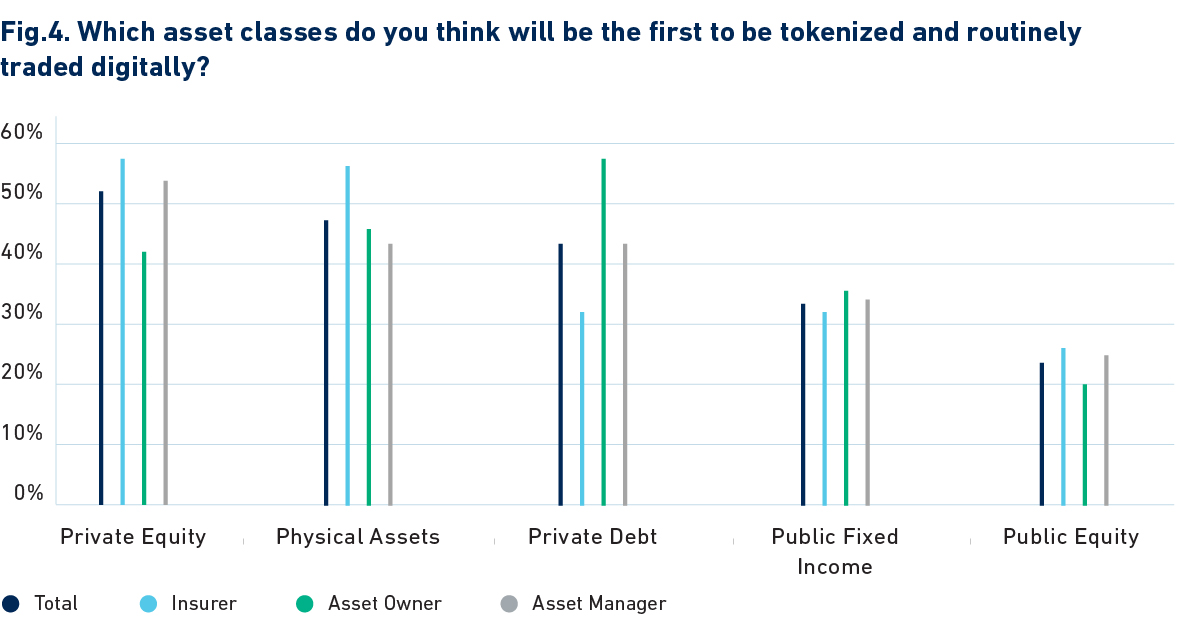

Illiquid assets such as private equity (51 percent), physical assets like infrastructure and real estate (48 percent) and private debt (44 percent) were the assets most respondents thought would be the first to be commonly traded digitally.

The bottom line: The benefits institutions want from asset tokenization and digital trading

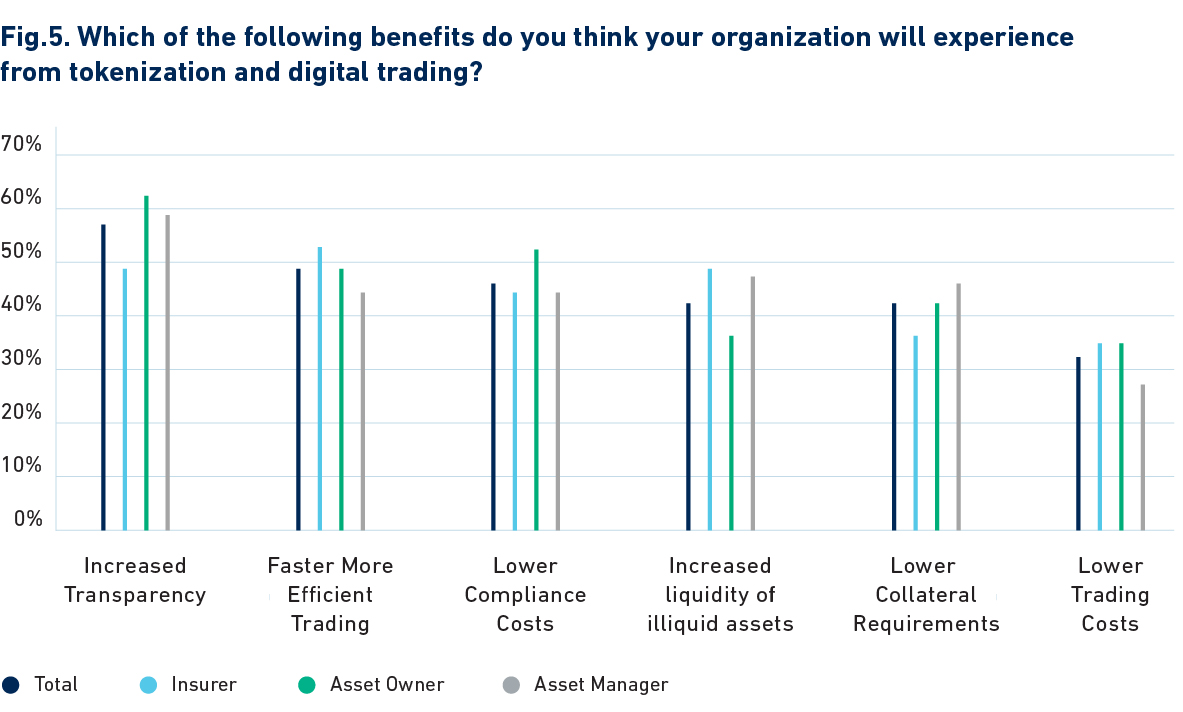

The focus among respondents, in terms of the benefits of tokenization, was largely on better process speeds and cost efficiency.

The operational areas where these improvements were mostly expected were risk management (47 percent), transactions management (45 percent) and collateral management (40 percent). Additionally, institutions largely expected these efficiencies to have a significant impact on the distribution of assets and the way they were presented to investors. Approximately two-thirds (64 percent) believed the advantages of digital tokenization in terms of faster processes and lower costs would make bespoke portfolios more common, at the expense of fund structures. Meanwhile, 22 percent felt the split of funds to bespoke portfolios would remain the same (15 percent said they did not know).

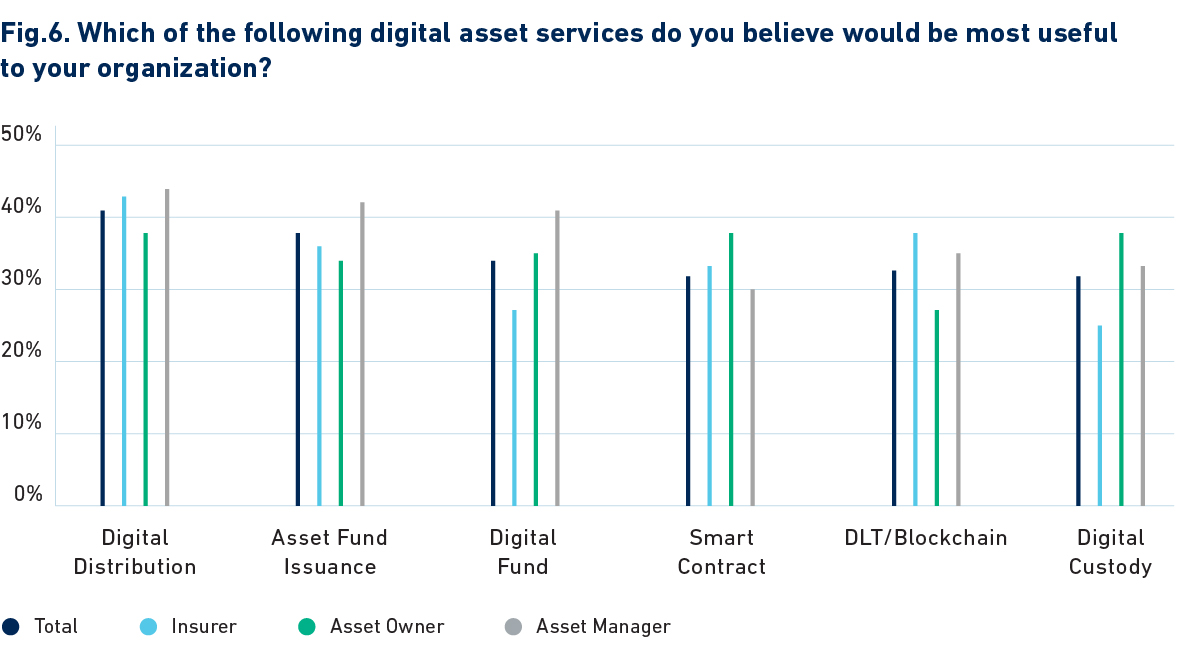

Distribution mechanisms, such as institutional digital wallets, were the areas most respondents wanted providers to address (41 percent), along with the issuance of tokenized assets (37 percent) and digital fund administration (34 percent).

Finally, respondents had mixed feelings about the potential ESG impacts of this technology. As many as 49 percent said it would be positive, while 42 percent thought it would not have an impact (only eight percent said it would be negative). Exactly half of those who thought it was ESG-positive felt quicker and effective trading operations would also be more energy efficient, while 42 percent thought digital tokenized fractionalization of green infrastructure assets would be a major ESG benefit. Around 41 percent thought the capacity of fractionalization to bring retail investors into private markets would enhance investor and regulator scrutiny of private companies with opaque governance models.

Those who felt it would be ESG-negative cited higher energy use in digital trading models (54 percent), the likelihood of increased (and inefficient) regulation of private markets following retail investors (46 percent), and more efficient capital markets generating increased demand for energy-intensive goods and services (38 percent).

Conclusion: An industry tentatively prepared for a digital tokenization revolution

This survey also shows a broad consensus among respondents that the technology underpinning cryptocurrencies will be applied to traditional assets. Very few respondents dispute this premise. However, the variety of responses to questions on digital investment preparedness, both across and between institutional investor types, is an indication of this technology’s nascency. Recent events, in particular the bankruptcy of digital exchange FTX in November, have shown that the infrastructure surrounding this area – and the ability of decentralized finance to merge with the traditional finance systems and processes designed to offer investors security and protection – remain a work in progress. However, this data shows these are questions the industry is at least asking and in many cases, actively addressing. Institutional investors recognize the benefits that digital tokenization can bring to their clients and members, and are largely keen on an ecosystem that allows them to garner those benefits with confidence.