Insights

July 2021

Where Is Momentum?

Is it better to focus on single-stock, industry or factor trends? And how does market risk and time horizon affect them? We use a unified framework to map out the distinct sources of momentum and reversal in the stock market.

A variety of stock momentum and reversal effects have been documented in financial literature, but it’s hard to unify these often disparate findings. We disentangle the overlapping effects of momentum and reversal to show where the most durable relationships lie. We drill into industry, factor, and security-specific momentum in US equities, separating high versus low market volatility, ‘past winners’ versus ‘past losers’, and the periods before and after the global financial crisis. We find that many distinct sources of momentum and reversal coexist, short term reversal has intensified post-2010, winning sectors tend to crash more than winning factors, and more.

Key Highlights

Most people believe that for stock returns, the past can predict the future… at least in part. Momentum and reversal effects are prevalent for individual stocks, and also for industries, sectors, and factors like value and size. This raises an interesting question: do these dynamics coexist, or do they overlap, with some effects dominating others? To answer this question, we look at stock-specific return prediction, and we decompose a multitude of momentum effects in one coherent framework.

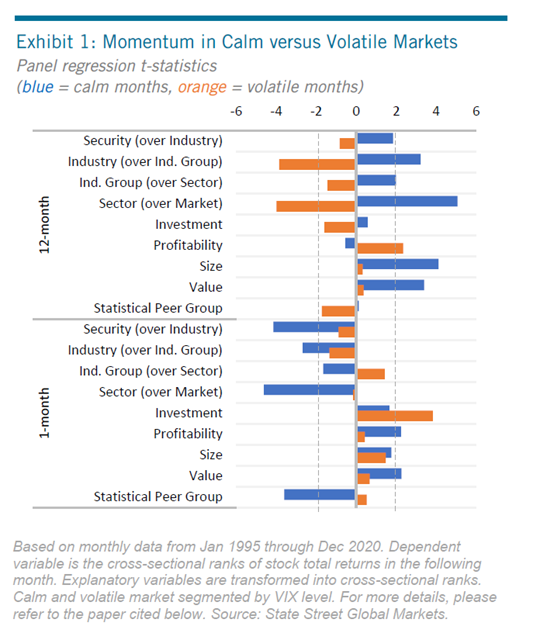

Our analysis pools together the returns of S&P 500 stocks over the past 25 years. We regress a stock’s total return in a given month on 18 types of lagged returns. Half of these returns are about the previous month, and the other half are about the 12 months before that. Beyond just a stock’s own idiosyncratic return, we include the returns of broader groups of which that stock is a member: its sector, industry, style factors, and even a statistically-derived set of ‘peers.’ We also allow for the possibility that momentum works differently in calm versus volatile markets. Our goal is to create the cleanest possible attribution.

Exhibit 1 summarizes the key results, using t-statistics to capture the sign and strength of each component. It turns out that many distinct sources of industry and factor momentum coexist. Moreover, they collectively explain away a large portion of stock-level 12-month momentum, which in the absence of other variables would appear to be a dominant force. In contrast, 1-month reversals remain highly significant for individual stocks, and for sectors too. Digging deeper, we can see that industry and sector momentum tend to crash in volatile markets, whereas factor momentum signals do not. We can’t say exactly why, but perhaps the ever-evolving composition of factors insulates them from the excesses that cause sector sell-offs.

In our full paper, we extend the decomposition further. For example, we find that the largest share of the pro-momentum effect comes from stocks that went down going down more; gains are less reliable. We also find that in the past decade, pro-momentum has generally weakened, while at the same time reversals have strengthened. With consistent assumptions and careful calibration, we disentangle momentum effects to pinpoint where the most durable relationships lie.