Insights

April 2021

History, Shocks and Drifts: A New Approach to Portfolio Formation

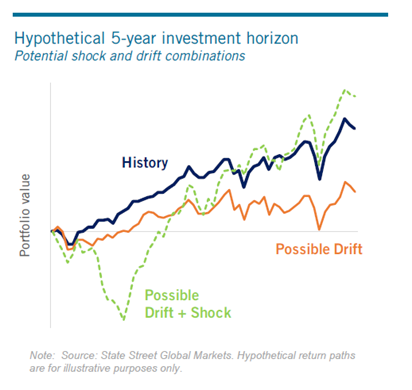

Portfolios face many risks. Some may be gradual but persistent, like climate change and demographic shifts; while others happen suddenly, like pandemics or financial crises.

To manage the possibilities, investors must unify their view of major events that might happen over long intervals with those that might happen along the way. The future will surely bring both, with echoes of history and a healthy dose of new trends. We propose a method of portfolio construction that accounts for complexities while recognizing that most investors care about performance measured over many frequencies — monthly, yearly, five-year, for example — not just one or the other. We show how to create a sample of mixed-frequency scenarios that is balanced and consistent. We also show how to form portfolios that consider all of the returns of this sample, rather than a statistical summary of them.

Dealing with “Big Risks”: Portfolio Construction to Face Shocks and Drifts

Manage what matters, whether it happens fast or slow

Nautical analogies are apt for investing. As a ship’s captain, should you worry more about navigating to your final destination, or surviving storms that may hit along the way? This is a false choice, of course, because ships that sink and those that wander aimlessly with ocean currents are both rather useless. Moreover, the two concerns are linked: storms may knock you off-course, and different routes face different weather.

Investors must equip their portfolios for a similar, dual objective. They must survive pandemics, financial crises, and other adverse events. Yet they must also prevent the more subtle but persistent effects of climate change and demographic shifts from undermining their end goals. Unfortunately, traditional portfolio construction tools are tuned to manage either shocks or drifts, but not both.

To unify shocks and drifts requires that we view short-term and long-term effects at the same time. This is a challenge because, although the two are interwined, they manifest quite differently. It helps to view the future as a path that contains both shocks and drifts. Since it is uncertain, we need to consider many overlapping possibilities. From these, we create a mixed-frequency return sample. This means that for each of our paths, we record monthly return outcomes alongside annual outcomes, and even 5-year outcomes. The only requirement is that we maintain their natural proportions: for every 5-year return, we must record 5 corresponding years, and 60 corresponding months. In this way, we can mix and match historical experience with forward-looking views for shocks and drifts.

This multi-frequency return sample preserves an important balance – the wide scope of long-run outcomes neatly offsets the fact that we record fewer of them. The last step is to choose an asset mix that stands up to the scrutiny of our carefully-constructed sample. For each observation, a candidate portfolio has a defined return, and an investor’s “utility” tells us the degree to which this return causes joy or suffering for that horizon. The portfolio that fares best on average across every test in our sample is the one to pick. It is the most seaworthy vessel we have.