Insights

September 2020

Decarbonizing Everything: Climate Data, Industry Returns and Portfolio Construction

In the era of climate change, investment managers are grappling with how to make sense of different approaches to climate data to improve portfolio outcomes.

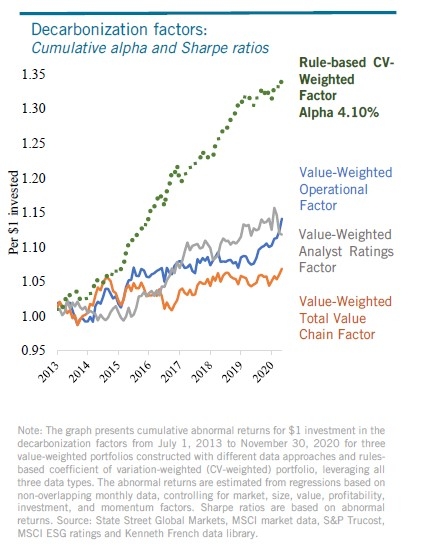

In our research with Professor George Serafeim at Harvard Business School, we start by testing the circumstances in which three types of qualitative and quantitative measures of carbon risk, including upstream and downstream characteristics, add value to portfolio construction. We discovered a clear way to identify which data matters the most for a given industry. The metrics that vary widely across firms in an industry are effective at predicting returns. This dispersion is calculated through the “coefficient of variation” for each metric in each industry. These (and other) insights for determining the merit and applicability of climate data can then be applied in rules-based trading models

Our rule is a systematic process of choosing a different type of climate metric across industries. Playing to the strengths of various types of climate data can help investors design strategies to manage climate risk while increasing risk-adjusted returns. By using more sophisticated rules, we suspect investors could produce even better results.

Key highlights

Liquidity has the nasty habit of an unreliable friend: it is often hardest to find when you need it the most. Rising cash demands can pose a challenge for asset owners who have large commitments to private assets. This raises an important strategic question: what is the right amount of liquidity to have in the first place? While it is common to use expected return and risk in portfolio construction, liquidity is typically ignored. This simplification results in overallocations to less liquid alternatives.

We propose that investors translate liquidity into units of return and risk using "shadow assets." This unified framework allows asset owners to address portfolio illiquidity in a more direct and transparent way. Climate metrics are not one size fits all. Careful choice of metrics pays off in portfolio performance.Market participants operating in an era of climate change aredemanding more data to measure upstream and downstream climate risk and opportunities.

How can investors use these different approaches to climate data in portfolio construction to improve outcomes?

This research was published in the Financial Analysts Journal, 2021

Our methodology begins by categorizing liquidity as either "playing offense" or "playing defense." Any trading that improves the portfolio beyond its buy-and-hold value, such as tactical asset allocation, represents playing offense. We attach shadow liquidity assets to the tradable assets in a portfolio to recognize these benefits. On the other hand, any trading that serves merely to preserve a portfolio's integrity, such as responding to capital calls, represents playing defense. We attach shadow liabilities to the non-tradable assets to recognize the cost drag they create through immobility. We must use simulation to measure these shadow allocations because they are unique to each investor. We first run a set of simulations where all assets can be traded at any time, followed by a second simulation that restricts trading in illiquid assets. The difference, net of trading costs, assigns a value to liquidity.

Take for instance the hypothetical portfolio shown in the exhibit above, which contains 25% hedge funds and 20% private equity. Only 55% of the portfolio has monthly liquidity to fund capital calls. Now, let's incorporate the benefits of liquidity and costs of illiquidity into our expected return and risk estimates. The optimal allocation to illiquid assets drops from 45% to 17%. This dramatic difference suggests that incorporating liquidity is a crucial step in portfolio construction. With the shadow allocation approach, it can be addressed rigorously and precisely.

For more on this topic, see our 2013 journal article: “Liquidity and Portfolio Choice: A Unified Approach” by Will Kinlaw, Mark Kritzman, and David Turkington, The Journal of Portfolio Management, Vol. 39, No. 2, Winter 2013.

Related Insights