Insights

June 2022

How Safe an Asset Is Crypto: A Look at Early Evidence

Safe haven assets have a near mythical property in financial markets. While there are plenty of fundamental narratives that explain their performance, it is sometimes unclear whether this comes before, after or even during the simple numerology of the said asset performing well during the most turbulent times.

In the case of gold, this empiricism has been established over centuries. For others such as Treasuries and the Japanese yen, it has been decades.

In the space of three years the current decade has brought a global pandemic, the deepest recession in the post-war period, the biggest inflation shock in 40 years—and now war. With the benefit of hindsight we go back to the beginning of 2020 and compare how bitcoin has fared relative to more traditional safe havens. The early evidence suggests it has held up reasonably well. Then we explore what may be bitcoin’s greatest challenge yet, the withdrawal of global liquidity that has sent global financial markets reeling.

Safety guidelines

The fundamentals of what makes assets “safe” are varied and complex. In equity markets, the utility and consumer staples sectors are assumed safe because consumer demand for their products is typically inelastic to price moves (although that will be tested this year with inflation at its highest level in decades in the United States, United Kingdom, Europe and elsewhere) or changes in income.

During the recent pandemic, this took another twist with consumer mobility drastically reduced. Companies and sectors that transacted primarily online were safe. United States Treasuries are considered safe because it is assumed the US will never default on its sovereign obligations. The Japanese yen, meanwhile, is considered safe as it is assumed during times of crisis, local investors will repatriate their holdings of foreign stocks and bonds. Gold is considered safe because it has proven to be a store of value during turbulent periods, because of its scarcity and its role in facilitating means of exchange. It is some of these later properties that can be applied to bitcoin to determine how it has acted as a store of value during turbulent times.

A look back with Chicken Little

To investigate the question of how bitcoin has performed compared to typical safe haven assets, we construct an experiment. A portfolio manager (we are calling them Chicken Little) comes into work on January 4, 2020 and decides this will be the decade where the sky really is going to fall and allocates funds to one of the potential safe havens we outlined above. To compare the assets together we scale the returns such that volatility is normalized to 10 percent per annum. So looking back at the beginning of second quarter 2022, which asset would have delivered Chicken Little the best returns?

Figure 1 shows what is initially, a surprising result. Some of the traditional safe havens have not just underperformed the 11 percent inflation seen over the period, but in absolute terms, holdings of both the Japanese yen and short-term US Treasuries are worth less today than they would have been at the beginning of 2020. Other utilities, consumer staples and gold did well as advertised, delivering cumulated nominal returns over 20 percent or an annualized real return of 2.9 percent. However, bitcoin’s nominal and real return was almost double this. This is still true even after its poor performance so far in Q2, a quarter during which a few of the traditional safe havens have also suffered uncharacteric (for them!) collapses. So with perfect foresight Chicken Little should have picked bitcoin on January 1, 2020, assuming it was a simple buy and hold volatility adjusted strategy. A fact that no doubt other Chicken Littles worried about turbulent periods may well take note of in the future.

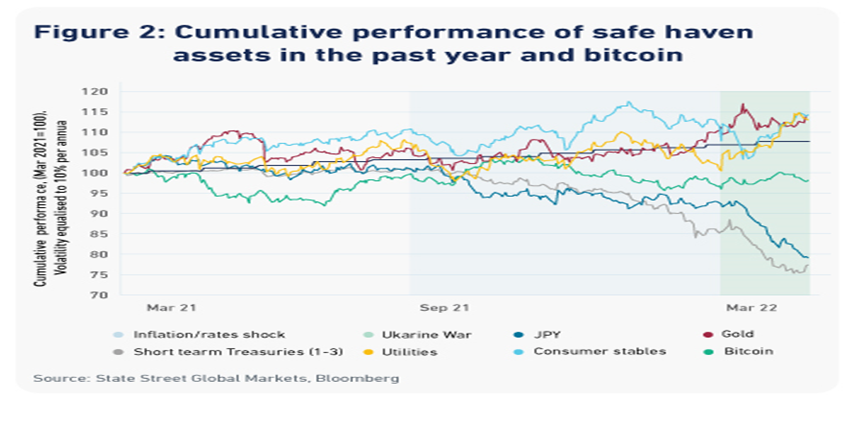

At face value this looks like a terrific result for bitcoin in spite of its current troubles. In the first three years in the most risk-prone decade in a long time, it has outperformed traditional safe haven assets on a risk adjusted basis. A healthy dose of caution, however, is required. Short-term bitcoin returns are positively correlated with equity returns, especially and unfortunately when equities fall. The end result of this experiment is also sensitive to the choice of starting point. If instead of the start of the decade Chicken Little was looking for their safe haven at the start of second quarter of 2021, the results are less impressive. As Figure 2 highlights generating returns above inflation has been a challenge; none of the traditional safe havens have beaten inflation, and some have even posted outsized losses in nominal terms. Bitcoin is, of course, included in this set, but on the all-important volatility adjusted basis, it has still done better than either the Japanese yen or short-term Treasuries.

The underperformance of these traditional safe havens, as well as the new contender, also serves to highlight an important point; crises are often different to what has gone before or at least recently. The inflation impulse created by the war in Ukraine on top of an already robust inflation trend has necessitated a dramatic response from central banks. So instead of the usual monetary accommodation to prevent a crisis getting worse, in 2022 the crisis itself necessitated the rapid removal of accommodation; hence the underperformance of Treasuries and yield sensitive Japanese yen. The result that Figures 1 and 2 demonstrate is that not every safe haven performs well necessarily in every crisis.

So there is some consolation in this for those hoping that bitcoin could yet be a safe haven vehicle. However, it also introduces an important caveat that is often cited when considering asset market performance in the past three years; it has been dependent on abundant liquidity. Massive fiscal and monetary stimulus to save the real economy channeled excess savings into asset markets, traditional and crypto alike. Now that monetary policy is being tightened to combat inflation, what will happen to all that liquidity?

The liquidity challenge

Arguably, this liquidity removal could pose an even bigger test for bitcoin, than the crises it has weathered in the past three years. On the one hand the fact that this is a risk for crypto assets in the first place is encouraging. When a rising tide of excess savings lifts the boat of many asset markets simultaneously, the fact that crypto is included in this pool shows its emerging acceptance. However, in a world of excess savings, crypto can attract inflows without the need to sell traditional assets. That will not be the case once excess savings have been unwound. In the US, we have only seen three months where the stock of excess household savings accumulated over the pandemic has been drawn down. At the same time, we are only two interest rate moves into the Fed’s tightening cycle and quantitative tightening is about to begin. While financial markets, of course, look ahead in an attempt to discount these moves, how markets react to the reality of tightening liquidity is still highly uncertain.

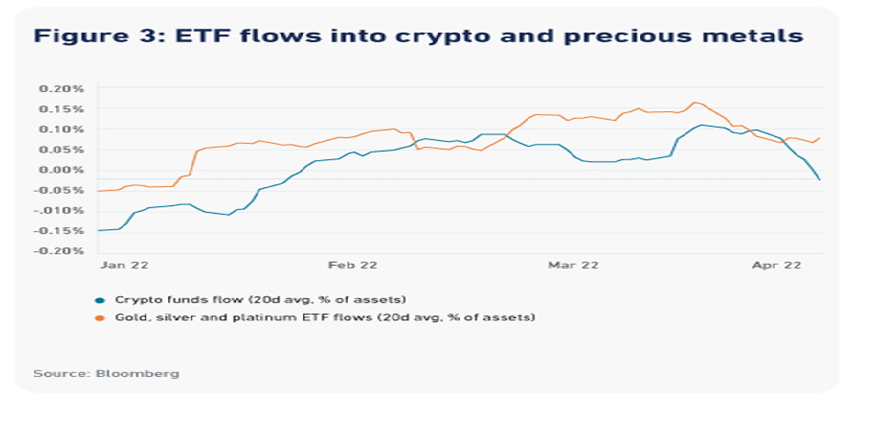

Fixed income markets have dug out their old playbooks from the last surprisingly robust Fed tightening cycle in 1994/95 and have been in full panic mode for much of the year. There was no such precedent for the crypto eco-system to follow, so volatility has come more recently.As turbulent as recent Bitcoin price action has been, what we would note so far is a relatively modest reaction from some crypto’s newer investors. Although inflows into bitcoin ETFs are small compared to other avenues for gaining exposure into crypto assets, their newness and traditional asset form has piqued the interest of new, less certain crypto investors. In February and March crypto ETFs attracted inflows of a similar scale (relative to assets under management at least) to the traditional safe havens in precious metals ETFs, up until the end of March (Figure 3). And while there have been significant outflows since then, they have (so far) only reversed the robust inflows seen the immediate aftermath of Russia’s invasion of Ukraine. This is not a good outcome, but nor are the cumulative level of outflows so far this year too troubling either. Not yet at least. Whether this will still be true as US interest rates head toward 2% and beyond over the summer is a key uncertainty though and reason for continued caution.

Stress tested

Safe haven assets are not created overnight. Even the most traditional assets that have built their reputations over centuries or decades can have bad crises. And, as we’ve seen recently, typically risky sectors like technology can perform well in times of crises. So far, as a buy and hold strategy crypto has done remarkably well in the turbulent markets of the 2020s. Time horizon, however, matters considerably to investors. Their appetite for both large gains and losses will determine what an optimal allocation to crypto should look like. Megan Czasonis, Mark Kritzman and Dave Turkington explore this in a recent paper published in the Journal of Alternative Investments. Even though bitcoin has not performed as well as other safe haven assets in the past year, its resilience to unprecedented re-pricing of policy accommodation has been impressive.

While Bitcoin might have passed this first medium-term test, it faces an even sterner test in the short-term with the rapid withdrawal of liquidity. Bitcoin is far from alone in facing this challenge. It is simply part of the rigorous stress test the current macro environment is presenting. Thus far the modest reversal of flows into new products like Bitcoin ETFs suggests this is a test Bitcoin may yet pass. But it is still too soon to say this with much confidence. What we do know, though, is that with the passing of each test, confidence in and credibility of some crypto assets will only grow.