Insights

How ETFs promote democratized access for investors

Findings from our recently concluded ETF@30 campaign reveal that one of the key features of the ETF is its ability to democratize access for investors. Our resident ETF expert, Frank Koudelka, connected with Charles Schwab’s Dennis Hudachek to discuss this attribute and how Schwab has developed its ETF offering as a result.

January 2024

Frank Koudelka

Global Head of ETF Solutions,

State Street

Dennis Hudachek

Director of ETF and Index Fund Product Management, Charles Schwab & Co., Inc.

US ETFs trace their origin to the stock market crash of 1987. First proposed by the Division of Market Regulation at the US Securities Exchange Commission (SEC) in its October 1987 Market Break report, the ETF or “basket of securities” would enable institutions to consolidate program trading into a single order.1 Nate Most and Steve Bloom from the American Stock Exchange then took this concept and partnered with State Street in 1993 to launch the Standard & Poor’s Depository Receipts, better known as SPDR S&P 500 ETF Trust (Ticker: SPY).

At the time of the first ETF launch, no one expected it to transform from a program trading tool to an investment wrapper that would open opportunities for retail investors to gain typically low-cost access to an asset class, sector or country/region with a single trade. In fact, ETF growth was quite muted in its early days, considering its narrow scope. However, as use cases, products and issuers expanded, the growth trajectory of the ETF accelerated.

Expansion to fee-based advisors

Following the initial adoption of ETFs by institutions, fee-based advisors began using the ETF investment wrapper as building blocks for asset allocation. Advisors were attracted by the generally low cost, accessibility, ease of trading and tax efficiency that ETFs offered for portfolio construction. Although ETFs had a lower cost structure compared to other investment products, one of the roadblocks to adoption was the commission charge per trade, which was US$12.95 a trade (or higher) on most brokerage platforms in 2010.2 At this time, only 2 percent or 2.3 million US households owned ETFs.3

According to an ETF investor survey in 2012, 82 percent of investors indicated commission-free trades were somewhat, very, or the most important, reason for investing in a particular ETF.4 At this time, Registered Investment Advisors (RIAs) held approximately US$150 billion in ETF assets or about 12 percent of the total.5 With a downward shift in trade commissions and expense ratios, these fee-based advisors were poised to encompass a growing share of the ETF market, propelling ETFs towards another phase of growth.

Disruption leads to growth

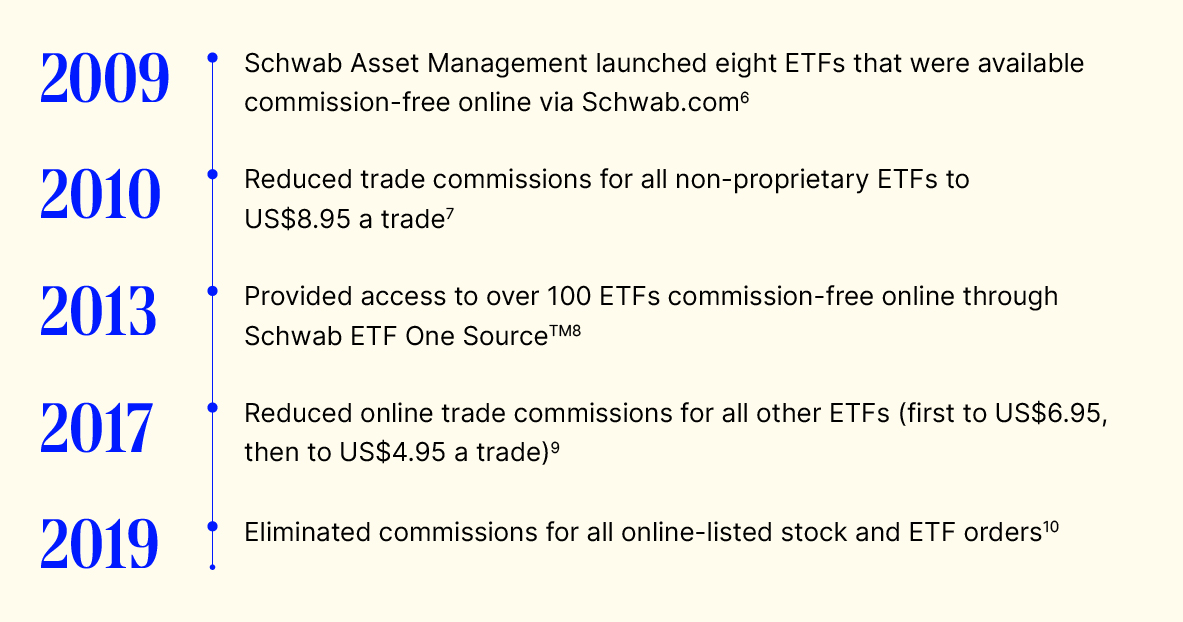

As one of the market’s leaders, Charles Schwab recognized this growth potential and ability for ETFs to level the playing field, and began addressing the overall cost of ETFs on two fronts. Its investment management arm, Charles Schwab Investment Management (CSIM), doing business as Schwab Asset Management, launched a suite of low-cost ETFs and the Charles Schwab & Co., Inc. brokerage platform began reducing the commission costs for online trading for both individual investors and investment advisors.

Charles Schwab’s vision to reduce overall costs for its clients, both in eliminating trade commissions and commitment to offering among the lowest cost ETFs in the industry, has resulted in Schwab Asset Management becoming the fifth largest ETF issuer in the US by assets under management (AUM).11 Meanwhile on its brokerage platform, Charles Schwab & Co., Inc. now holds more than US$1.6 trillion in ETF client assets.12

Overall, as a result of issuers and platforms (including Charles Schwab) reducing fees, we have seen:

- US household ETF ownership rose to 12 percent or 16.1 million in 202213

- Direct retail ETF ownership has increased from US$110 billion and 8.5 percent of overall ETF AUM in 2012 to US$1.1 trillion and 15.6 percent over all AUM in 202314

- The percentage of household assets invested in ETFs by fee-based advisors grew from 10 percent in 2011 to 41 percent in 202115

- Asset-weighted fund fees reduce from 0.92 percent to 0.37 percent – an astounding 60 percent reduction – which has saved investors billions of dollars in fees, since the inception of ETF in 199316

Demographic trends point to additional ETF growth in the near future.

Demographics and the future

The Silent Generation and Baby Boomers now account for close to US$97 trillion of the US$156 trillion in overall wealth in the US, compared to US$59 trillion held by Gen-X and Millennials.17 A further look at investment vehicles shows close to US$20 trillion of mutual fund assets held by households and 63 percent of that ownership held by the older generations.18 Conversely, the Millennials and Gen-Xers have a greater affinity for ETFs, with 89 percent of Millennials and 78 percent of Gen-Xers saying it is their investment vehicle of choice.19

A deep dive into individual investor habits shows that the online discount brokerage channel is the only one growing across 30-, 45- and 60-year-old investors over the past five years. The traditional broker/dealer, RIA and wirehouse channel growth have largely been flat for the same period.20

The great wealth transfer and the potential of ETFs

We are currently witnessing one of the greatest wealth transfers in history, as the youngest members of the Baby Boomers enter their 60th year and the Silent Generation enter their 80th year. It is estimated that by 2043, US$85 trillion in assets will be inherited by the Gen-X and Millennials.21 Industry surveys suggest that those poised to take on this enormous amount of wealth lean strongly in favor of ETFs as an investment vehicle.

With a significant move from mutual funds to ETFs already taking place in taxable accounts, these trends would suggest that as retirement assets are passed on to the next generation, another US$10 trillion in mutual funds could be moved to ETFs.22 We believe the timing couldn’t be better. The ETF market now offers more choice than ever with the expansion from broad cap-weighted index products (ETF 1.0) to factor-based smart beta strategies (ETF 2.0) and actively-managed strategies (ETF 3.0).

ETFs have democratized the investment landscape, offering the ability to invest across asset classes, sectors, themes and geographic locations, and further gain exposure to digital assets, commodities, precious metals, alternatives and enhanced income-oriented strategies. Today, investors of all types with access to an online brokerage account can construct a diversified ETF portfolio for as little as 4 to 15 basis points with zero trade commissions. We believe ETFs have revolutionized the investment landscape and will continue to grow in popularity.