Insights

August 2022

Effective Data Management for Insurers

In this study, we highlight some of the key trends on data management for insurers.

Companies need to ensure that they have a comprehensive and efficient data management platform, which can drive operational excellence, provide greater analysis capabilities and offer a focused business model.

Data management and data security are the key challenges that insurers face today. Datasets are growing bigger, more diverse and complex as insurance companies grow their businesses and expand their investment portfolios. Multiple datasets handled by various suppliers on different platforms adds to the complexity.

Our annual Growth Readiness Study1 shows that insurers around the world are looking to improve how they manage data to address these issues and enhance their performance across several areas.

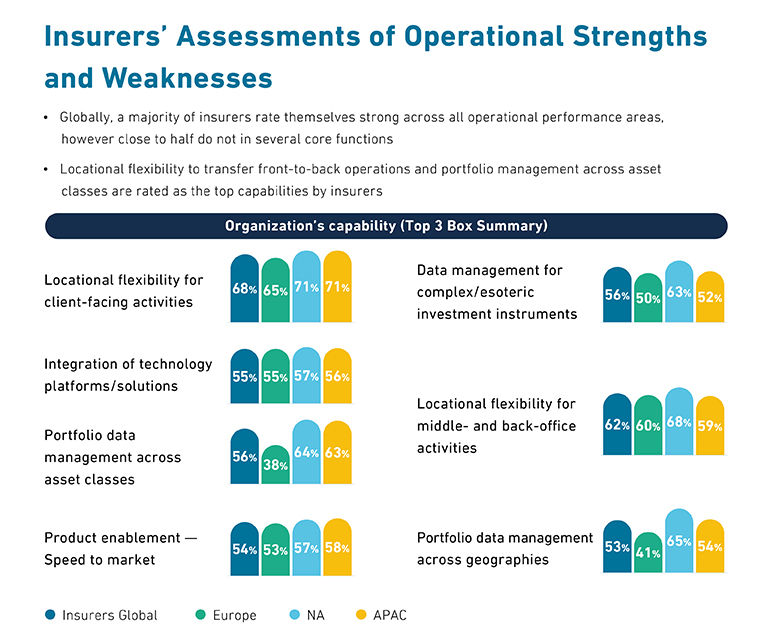

A significant proportion of respondents indicate that they have room to improve in areas such as portfolio data management across asset classes and geographies, and for managing complex or esoteric investments such as private markets.

Integrating new technologies or platforms, and optimizing speed to market and product development are also areas in which fewer insurers rate themselves as ‘strong’ when compared to other metrics.

Internal or external – or both?

Establishing and maintaining an effective data management system can be complex and resource-intensive. Many insurers, therefore, are opting to outsource this function by bringing in an external platform to amalgamate all data sources and streamline reporting and other processes.

Operational efficiency is an underlying factor – insurers seem to want fewer but better trained personnel while outsourcing to specialists for at least some functions. This is a far more palatable option than building internal capabilities, which can be time-consuming and expensive.

Additionally, there is the issue of data security. Holding large amounts of data and information on internal systems requires significant investment in cybersecurity and appropriate secure physical space for servers. By outsourcing this element, insurers can benefit from dedicated cloud servers with bespoke, cutting-edge security technology, which can be easily scaled up or down as needed.

However, it is clear that many insurance companies are considering a blend of internal and external resourcing. Two in five (43 percent) global insurers polled for the study say they are seeking to improve operational capabilities by outsourcing to a third party, but three in five (59 percent) say they are looking to make use of technology from third parties, such as cloud-based platforms.

Choosing to blend internal and external resources can be appropriate if the outsourcing provider has the flexibility to adapt to specific insurers’ operations and its technology can seamlessly interact with existing proprietary systems.

Getting the full picture

Each insurance company is unique: its products, clients, jurisdiction, size and other factors play a role in deciding what kind of data an insurer needs and uses. Each of these factors can change over time. So, insurers need a data platform that can adapt to changing business environment,product or investment strategy, or corporate activity.

Managing portfolio data across different geographies is a priority for a third of insurers, and many respondents acknowledge this as an area they need work on.

As regulations change and evolve, insurers must be ready to adapt – and efficient and cohesive data management can support this by providing transparency across asset classes and geographies.

Meanwhile, insurance company investment portfolios have become more complex over the past decade, with the addition of private markets asset classes such as private debt, infrastructure and private equity.

Each area of private markets comes with its own nuances, risks and cost of capital. Understanding these and adapting to them requires timely and accurate information – but acquiring this is challenging.

The reporting of even basic financial information is difficult in some of these areas and is often delivered in non-standard formats. It may be resource intensive even to get the data ready to use, which requires either significant investment in staffing or expensive technology upgrades.

By outsourcing to a specialist data platform, insurers can access institutional-scale resources and the latest machine-learning technology. Software can be programmed to ‘learn’ non-standard inputs and adapt them to a standardized format, which is ready for use by investment teams in a matter of seconds, while reducing the risk of human error. Accurate and quick data can help managers make efficient investment decisions and get to market quicker.

Data management and ESG

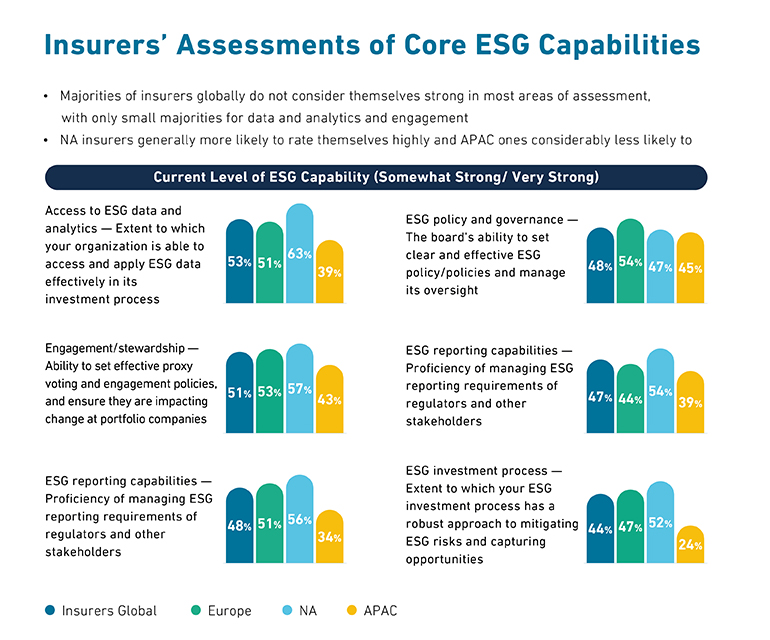

Half of the survey respondents feel that the reporting of ESG data will be a high or very high burden on compliance over the next three years, as regulators around the world introduce new requirements for companies and investors.

Less than half of the respondents rate themselves as “somewhat strong” or “very strong” on several areas of ESG investment and risk management, including the management of reporting requirements, and the ability to capture opportunities and mitigate risks.

In addition to evolving regulations, insurance clients are also scrutinizing their providers and suppliers more than ever. Insurers must be cognizant of client expectations when it comes to appropriate investments, whether in relation to climate change and fossil fuel companies, or social issues such as human rights and the living wage.

Insurers can put themselves at risk of damaging their reputation if they do not have a full view of their investment portfolios. Understanding the make-up of investment portfolios at a granular level is important if investors are to successfully manage ESG-related risks connected to the companies and assets they ultimately own.

While ESG and sustainability data standards are improving – supported by international developments such as the Task Force on Climate-related Financial Disclosures (TCFD) and the European Union’s (EU) Sustainable Finance Disclosure Regulation (SFDR) – there are still many instances where data is patchy or inconsistent. Regulations such as the SFDR and the EU’s Sustainable Finance Taxonomy are still evolving and expanding. Hence, data processing platforms need to be adaptable and flexible as new requirements and data sources emerge. Insurers need effective data management and analysis capabilities that can help resolve existing challenges, while retaining the flexibility to integrate new data sources and inputs when they become available. This can help to stay updated on developments in the ESG and regulatory spaces, while also enhancing insurers’ ability to manage risks and identify opportunities.

Data analysis

The sheer volume of data available in multiple formats can be overwhelming for traditional analysis models. In addition, a fragmented or siloed approach to data creates its own challenges, as investors are unable to spot correlations across silos or efficiently share different kinds of data across teams. Fragmentation can also result in conflicting or unverified data that can be difficult to resolve.

Aggregating this data can be time-consuming and complex, potentially compromising any ability to make timely decisions. This is particularly an issue when markets can move exceptionally fast in reaction to news.

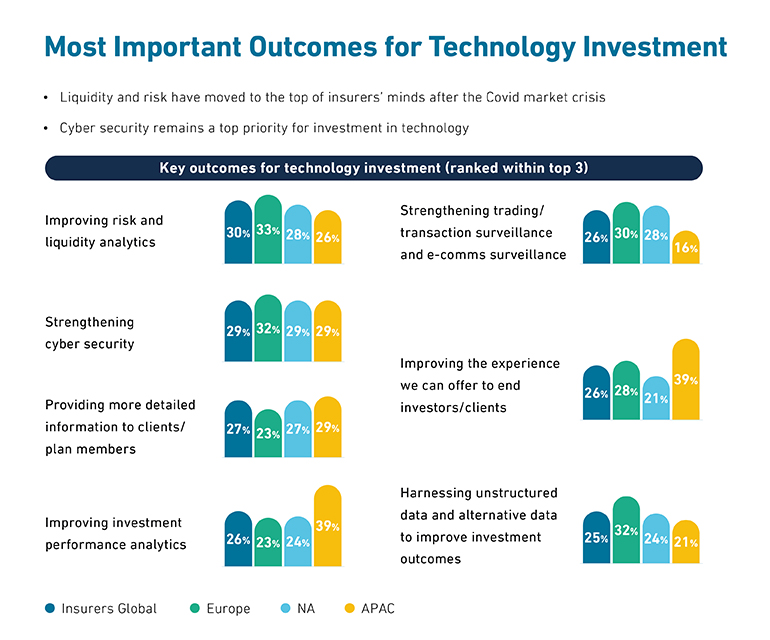

Consolidating all data sources onto one platform can provide insurers with a significantly more cohesive analysis capability. For insurers, this can improve the efficiency of their investment functions but also enhance their risk and liquidity analytical capabilities. This is a priority for many insurers, as our survey shows.

A cohesive data platform can also process other kinds of data, such as various forms of liability and product information, to create a full, timely and accurate picture of an insurer’s liquidity position.

It can help improve risk management capabilities through more accurate analysis of risks, whether they emanate from the investment portfolio or from the liability side of the business. Accurate data management and analysis can also be crucial in maximizing the potential of asset allocations within insurers’ capital constraints. Obtaining a full and accurate picture of an investment portfolio can ensure regulatory compliance across multiple jurisdictions while also protecting insurers’ ability to invest and meet their needs.

Introducing State Street AlphaSM Data Platform

We have been working closely with insurers and other institutional investors for decades. We understand the issues companies face when managing data on a massive scale.

By end of 2021, we had a total of 19 Alpha clients and were recognized with multiple industry accolades during the year, including “Best Front-to-Back Office Integration” by Waters Technology Asia Awards; “Investment Excellence in Tech Innovation” by Global Investor Group, and “Front-to-Back Partnership of the Year” by Global Custodian.

Alpha Data Platform (ADP) provides institutions with a one-stop data management service that can combine, streamline and scale up insurers’ ability to process all kinds of information. Our solution provides a seamless environment for collecting, curating and validating data that drives the investment processes. It is a fully open and interoperable model that enables the integration of clients’ data and that of third-party services.

This cohesive approach to data is particularly important in private markets. Different private markets asset classes have different data standards, which can also vary by manager or jurisdiction. For ESG criteria, data is often inconsistent or evolving. ADP integrates multiple private markets data sources and types, and standardizes them into a consistent, coherent report to accurately illustrate a portfolio.

ADP creates a ‘single source of truth’ across the front, middle and back-office functions of any investment institution, incorporating any proprietary systems or data sources, offering the flexibility to adapt as a business changes and grows.

With easy access to aggregate data, analytics and real-time insights, insurers can:

- Collaborate with confidence: Our secure cloud-based platform is easily and safely accessible from anywhere with an internet connection, enabling collaborations within and across teams, wherever they are located.

- Make better decisions, faster: Amalgamated and standardized data gives you quick and easy access to the information insurers need. This supports efficient decision-making and helps companies get to market faster with new products or services.

ADP is compatible with all external providers, allowing insurers to keep their existing datasets, while accessing the additional resources of the platform. It can also plug into proprietary systems to ensure business as usual.

Along with standardized data, ADP and State Street AlphaSM Data Services (ADS) can provide insurers with powerful performance and risk analytics. Our solution also provides intra-day or start-of-day transparency for the front office to provide insurers with a timely, accurate and holistic view of their portfolio.

We have a global presence in more than 100 geographic markets, covering major jurisdictions that can help insurers meet reporting requirements, supported by a cohesive and efficient data management and analysis tool.

Outsourcing data functions and analysis presents insurers with the chance to rethink and refine operating models. Our solutions enable insurers focus on core competencies without investing in new systems or in-house teams, and meet the requirements of their sophisticated and complex investment portfolios effectively.