Insights

June 2021

Climate Change Vulnerability and Currency Returns

Substantial physical impacts from climate change are already happening around the world and are expected to accelerate in the next few decades.

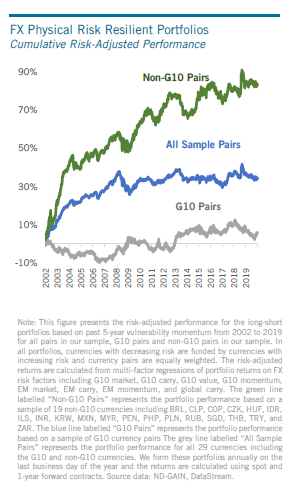

Using measures of physical risk from climate change, we develop a methodology to allocate currency pairs according to a country’s vulnerability to climate change. In turn, we use this to demonstrate how investors can construct portfolios with decreasing vulnerability to physical risk. During our sample period of 2002 to 2019, physical risk-resilient portfolios with decreasing vulnerability generated positive excess returns that were predominately driven by emerging market currencies. Our study provides early evidence of how investors could use liquid FX instruments and climate change fundamentals to manage physical risk and preserve asset values in domestic and foreign currencies.

Key Highlights

Past trends in climate vulnerability predict currency returns. Investors can build physical risk resilient portfolios to manage physical risk from climate change with liquid FX instruments.

Climate change has already had substantial physical impacts across countries. Even if we were able to stop emitting carbon today, these physical impacts are expected to accelerate in the next years and decades. Notably, physical risk from climate change is highly localized, meaning that some countries and economies have higher vulnerability to climate change than others due to geographic locations, variations in climate sensitivity, and differences in adaptive capacity. In this study, we investigate the relationship between physical risk and currency returns, and demonstrate how investors can build climate resilient portfolios in the FX market.

First and foremost, we find past trends in climate vulnerability predict currency returns, using vulnerability data from ND-GAIN. While the level of climate vulnerability can be largely explained by economic fundamentals, we find only a small proportion in the vulnerability momentum can be analogously explained, suggesting that most information in vulnerability momentum is not yet reflected in the country-level characteristics. We then demonstrate how investors can construct portfolios with decreasing physical risk based on past 5-year momentum in vulnerability with 29 of the most traded currencies across developed and emerging markets.

During our sample period 2002-2019, this physical risk resilient portfolio generates a positive and significant alpha, after controlling for a set of fundamental macroeconomic factors and common FX risk factors. Particularly, we find this phenomenon is more pronounced among non-G10 pairs, predominately driven by EM currencies. Moreover, double-sorting on both level and momentum in vulnerability reveals that the level of vulnerability provides important context to vulnerability momentum – improving from a risky base is rewarded more than improving from a less risky base. In addition, we find emerging economies have higher climate vulnerability than developed economies due to lower adaptive capacity instead of exposure or sensitivity; however, this vulnerability gap between EM and DM has been shrinking over time. By linking to natural disaster loss data, we confirm that more vulnerable countries experience greater economic losses and more human lives affected by natural disasters.

We hope our study provides early evidence in a portfolio setting of how investors could use liquid FX instruments and information in climate vulnerability to manage physical risk and preserve asset values in domestic and foreign currencies.

Related Insights