Insights

July 2020

How Does the Illiquidity of Private Markets Affect Asset Allocation?

Our research on liquidity and portfolio choice provides a framework for asset owners to evaluate the benefits of liquidity and costs of illiquidity, and implications for strategic asset allocation.

Investors intuitively understand that the ability to trade confers some additional benefit and that the inability to trade has a cost. Even a small amount of illiquidity could create an opportunity cost for the portfolio.

Our liquidity framework reflects the value of liquidity by attaching shadow assets to tradable assets and shadow liabilities to non-tradable assets. In doing so, we measure these benefits and costs explicitly in units of portfolio return and risk, which can be incorporated into standard portfolio construction algorithms such as mean-variance analysis.

Key Highlights

Liquidity has the nasty habit of an unreliable friend: it is often hardest to find when you need it the most. Rising cash demands can pose a challenge for asset owners who have large commitments to private assets. This raises an important strategic question: what is the right amount of liquidity to have in the first place?

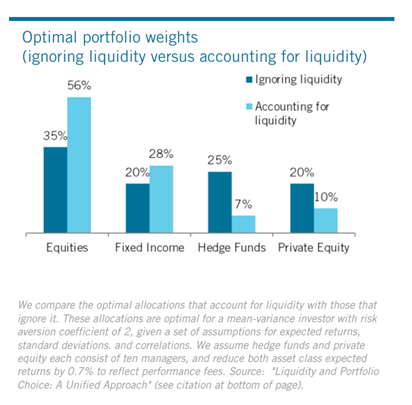

While it is common to use expected return and risk in portfolio construction, liquidity is typically ignored. This simplification results in overallocations to less liquid alternatives. We propose that investors translate liquidity into units of return and risk using "shadow assets." This unified framework allows asset owners to address portfolio illiquidity in a more direct and transparent way.

Our methodology begins by categorizing liquidity as either "playing offense" or "playing defense." Any trading that improves the portfolio beyond its buy-and-hold value, such as tactical asset allocation, represents playing offense. We attach shadow liquidity assets to the tradable assets in a portfolio to recognize these benefits. On the other hand, any trading that serves merely to preserve a portfolio's integrity, such as responding to capital calls, represents playing defense. We attach shadow liabilities to the non-tradable assets to recognize the cost drag they create through immobility. We must use simulation to measure these shadow allocations because they are unique to each investor. We first run a set of simulations where all assets can be traded at any time, followed by a second simulation that restricts trading in illiquid assets. The difference, net of trading costs, assigns a value to liquidity.

Take for instance the hypothetical portfolio shown in the exhibit above, which contains 25% hedge funds and 20% private equity. Only 55% of the portfolio has monthly liquidity to fund capital calls. Now, let's incorporate the benefits of liquidity and costs of illiquidity into our expected return and risk estimates. The optimal allocation to illiquid assets drops from 45% to 17%. This dramatic difference suggests that incorporating liquidity is a crucial step in portfolio construction. With the shadow allocation approach, it can be addressed rigorously and precisely.

For more on this topic, see our 2013 journal article: “Liquidity and Portfolio Choice: A Unified Approach” by Will Kinlaw, Mark Kritzman, and David Turkington, The Journal of Portfolio Management, Vol. 39, No. 2, Winter 2013.