Insights

Peer-to-Peer Platforms: Streamlining Repo Markets

The market for repurchase agreements (repo) serves the crucial function of supplying liquidity by allowing the temporary conversion of securities into cash, without the need for an outright sale.

June 2023

The average daily turnover in the United States repo market is US$4.7 trillion, including US$2.6 trillion of repo agreements and US$2.1 trillion of reverse repos.1 Despite the size of the repo market, the transaction process upon which it runs has remained primarily analog in a world that is rapidly becoming digital.

Most trades fall into one of two categories: tri-party, where an agent facilitates and administers settlement for a fee; and bilateral, in which an investor and collateral provider directly exchange cash for securities and handle the processing themselves for each transaction. Participants have the choice of spending time or money – either of which may be a significant drain on resources.

These solutions primarily involve intermediation — whether by a broker, dealer or tri-party agent — and are largely manual or partially automated. However, technology has found a way to offer an innovative alternative: a peer-to-peer (P2P) platform for the repo market.

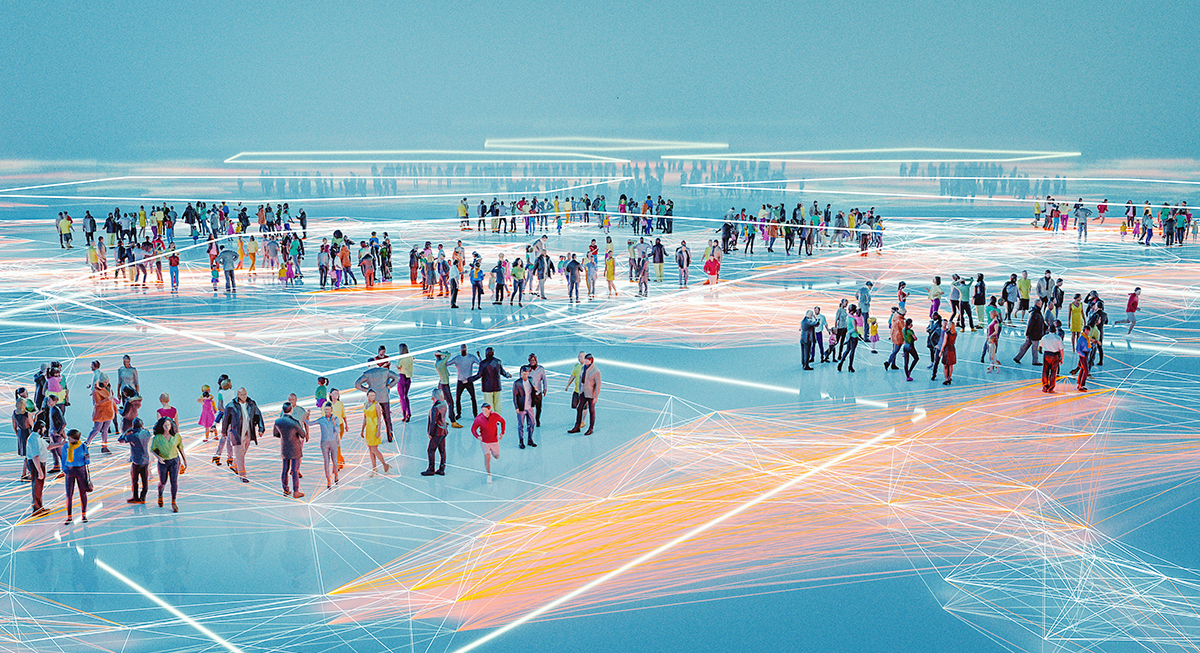

P2P platforms allow buy-side firms to transact directly with non-dealer counterparties, potentially increasing their liquidity pool and price transparency. The new technology also enables a significant move toward an automated front-to-back solution and straight-through processing, accelerating transaction timing and trade transparency.

Eliminating intermediaries

Traditional bilateral trades require a Master Repurchase Agreement (MRA) to be negotiated with each counterparty. By contrast, with a P2P platform, participants only need to execute one set of documents, after which they can transact with anyone else in the pool, relieving a significant legal and administrative burden.

A single platform can offer the participants a window to negotiate on their own terms directly with each other. Such a platform could also include a broad set of acceptable collateral types from agency mortgage-backed securities (MBS) to investment-grade corporate bonds, which can offer higher rates relative to US Treasury securities. Under the traditional system, counterparties with the same requirements would need to go through an intermediary, or find a suitable counterparty themselves, and then handle all of the operational, legal and risk requirements.

With a guaranteed P2P model, a bank or insurer can assure the repo seller’s performance to the buyer. Once the platform provider has verified collateral eligibility, credit and compliance checks, it assumes the risk of a collateral provider (e.g., hedge fund) default and guarantees performance to the cash provider (e.g., money market fund). This structure can facilitate interaction between an unrated collateral provider who might be ineligible to directly interact with a pension or money market fund, broadening the latter entities’ available counterparty base.

The technology’s automation of transaction processing and settlement relieves the pressure on buy-side firms’ operations teams and minimizes manual errors. On a platform, inventory uploads can be done automatically and systematically, resulting in greater efficiency. Post-trade messaging around the movement of funds and securities is also automated. With repo transactions requiring a quick turnaround and robust operational oversight, including next-day unwind of overnight trades and daily margining for term trades — reliance on manual processes is another challenge that an automated platform can resolve.

Shifting the burden increases effort

In the past decade, many buy-side firms outsourced most functions to clearing banks to reduce cost and decrease operational burden.

Even with the appropriate internal infrastructure, most buy-side institutions are ill-equipped to take advantage of rapidly rising short-term interest rates at a time when they are flush with cash.

Strength in numbers

Over the last few years, the Federal Reserve stepped in as a dominant player by offering reverse repos to cope with the unprecedented amount of excess cash. Although it seems peculiar to suggest a market with daily turnover of almost US$5 trillion can lack liquidity, history has shown the repo market is not immune to stress, as seen in 2019, when a confluence of factors led to a liquidity crunch in the market.

The Federal Reserve’s future path remains uncertain and data-dependent. However, once it subdues the inflationary challenges, we should see improvement in the rate environment, resulting in incentives moving further out on the curve. Quantitative tightening will continue to put pressure on repo rates, increasing returns available for investors and driving borrower demand for financing optimization. Participants who are on a platform that facilitates quick decision-making for trading with a wide array of counterparties that are easily accessible will be well-positioned with a powerful and augmented repo network.