Introducing The State Street Institutional Holdings and Risk Appetite Investor Indicator

Information is key to helping investors make better decisions. And for almost two decades, State Street has released an investor confidence index measuring the confidence level of institutional investors using an aggregated and anonymized pool of trillions of dollars in custodial assets.

That was a great start, but we want to provide more transparency into what was driving movements. And that's why we've created two new monthly indicators the State Street Institutional Investor Holdings Indicator and the State Street Institutional Investor Risk Appetite Indicator.

The indicators are rooted in scientific methodology. They use hard data facts and not just surveys, which can be subject to interpretation.

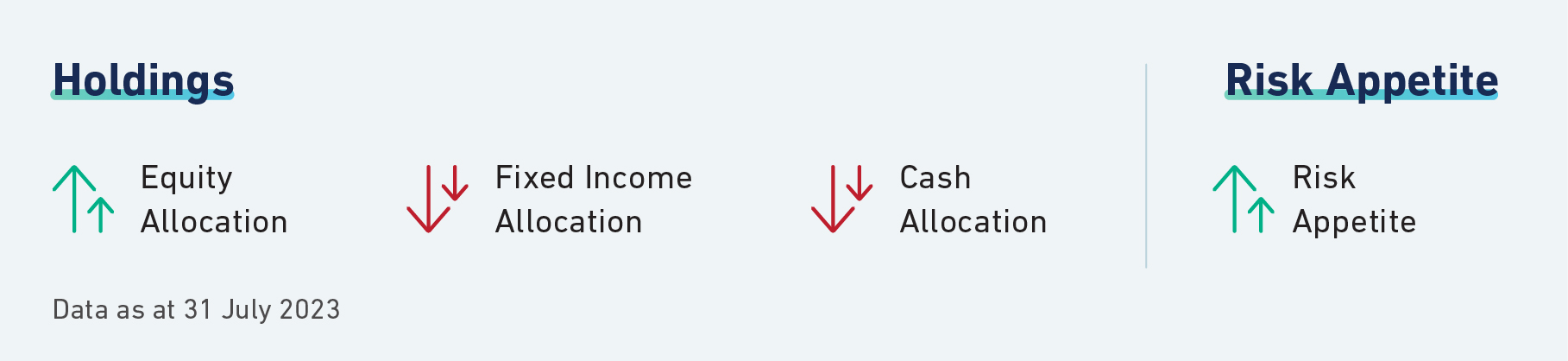

The State Street Holdings Indicator shows the aggregate holdings of institutional investors across three asset classes stocks, bonds and cash .And this simple information can actually tell us a lot about investor views.

The State Street Risk, Appetite Indicator is based on flows, so buying and selling patterns rather than portfolio positions. So it's more about the direction of travel rather than the current position. Let's start by taking a closer look at the Holdings Indicator.

When institutional investors hold excess cash, it usually means they're bearish on stocks, while holding more stocks than usual means they're more bullish. In 2008, during the Global Financial Crisis, as an example, institutions sold stocks aggressively from the fall of 2008 and into early 2009.Then they started buying back stocks in early March of 2009, just as the market bottomed out and they wrote it back up. In this instance, that inflection point and Holdings signalled the beginning of a sustained recovery in share prices that lasted several years.

Next, let's look at the Risk Appetite Indicator. This indicator ranges on a scale from minus one to plus one, and it looks at 22 different dimensions of risk taking that are available to investors. taking that are available to investors. For example, buying emerging markets and selling developed markets is one way of taking risk. Buying high yield bonds and selling investment grade bonds is another. And we look at 22 of these dimensions. A score is given to the buying behavior patterns. And each of these risk categories from minus one to plus one, where plus one is the most risk seeking behavior.

A good example of this was the onset of the Covid-19 pandemic in early 2020. The indicator had already started plummeting by mid-February, at which point markets had only suffered modest losses. But it signalled correctly that the worst was yet to come, and markets fell sharply during February and March. Then the indicator flipped back to positive in the first week of April 2020 as the markets began to rebound, signalling the beginning of a sustained rally in stocks after COVID. That lasted until the end of 2021.By sticking to the facts, we hope that the State Street Investor Risk Appetite Indicator and Holdings Indicator will be useful tools for investors to understand and navigate our changing world.

Look out for them each month along with expert commentary from our Macro Strategy team at statestreet.com or on our Insights platform. ***ends***

-------------------------------------------------------------------------------------------------------------------------------

Disclaimer

This video is for general, marketing and/or informational purposes only. It is not intended to provide legal, tax, accounting or investment advice, and it Is not an offer or solicitation to buy or sell any registered product, service, or securities or any financial interest, nor does it constitute any binding contractual arrangement or commitment at any time. Products and services may be provided in various countries by the subsidiaries and joint ventures of State Street. Each is authorized and regulated as required within each jurisdiction or in any circumstance that is otherwise unlawful or not authorized. To the extent it may be deemed to be financial promotion under non-US jurisdictions, it is provided for use by institutional investors only and not onward distribution to, or to be relied upon by, retail investors.

This information is provided "as is" and State Street Corporation and its subsidiaries and affiliates ("State Street") disclaims any and all liability and makes no guarantee, representation, or warranty of any form or in connection with the use of this communication or related material. No permission is granted to reprint, sell, copy, distribute or modify any material herein, in any form or by any means without the prior written consent of State Street.

To learn how State Street looks after your personal data, visit: https://www.statestreet.com/utility/privacy-notice.html. Our Privacy Statement provides important information about how we manage personal information.

No permission is granted to reprint, sell, copy, distribute, or modify any material herein, in any form or by any means without the prior written consent of State Street.

Copyright ©2022 State Street Corporation and/or its applicable third-party licensor - All Rights Reserved

State Street Corporation, One Lincoln St, Boston MA 02111

Adtrax Tracking Number : 5548218.1.1.GBL.INST

Expiration date: 22 March 2024